Top 15 Insurance Portal Software Solutions: Redefining Efficiency in Policy Management

Think of insurance portals as your personal digital assistant for all things insurance. They're not just for looking up policies; these web applications let you easily view and manage your insurance online.

For us, the main draw of these portals is their ability to showcase a variety of insurance products from different companies in one place. It's like having a single platform where you can compare and choose what works best for you.

These portals also make life easier for customer service reps. They can quickly access your policy details, making it a breeze to handle renewals and any inquiries you might have.

One of the best parts? Insurance portals automate many of the manual, time-consuming tasks in the insurance process. This means less paperwork for you and lower operational costs for the companies.

Whether it's a ready-to-use software solution or a custom-developed tool, insurance portals are designed to fit various needs. They're about making your insurance experience smoother, more efficient, and hassle-free.

In this article, we will provide you a comprehensive list of the best insurance portal solutions with their key features, so that you can choose the right tool for managing your insurance operations.

What function does an insurance portal serve?

Policyholders may use a portal to look for insurance, purchase it, file claims, pay bills, and update their coverage as their financial circumstances change. Agents may also use it to request quotes, send information about claims, and renew policies.

Property and casualty insurers can improve policyholder relationships and agent ties by using insurance portals.

However, many insurers implement their portal as a one-size-fits-all solution, resulting in results that are hardly exceptional.

Insurance portals can be created to provide enhanced security and accuracy standards that enhance the purchasing process while allowing access to a wide variety of different insurance products directly from providers.

Even though insurers use insurance portals primarily, consumers can also find pertinent information about various insurance plans on a single platform thanks to them, which is why portal development is now crucial.

A portal can help agents find insurance products that are pertinent to their clients' needs while also giving consumers up-to-date information on the various policy plans that are on the market.

What are the uses for insurance portal software?

Depending on the business model and product offerings of the insurer, insurance portals provide a wide range of different functions.

1. Policy Access and Renewal: Enables customers to view, renew, and track payments for their insurance policies online.

2. All-in-One Insurance Management: Offers a central platform for customers to manage various insurance needs, including checking the status of claims, account balances, and payment history.

3. Agent Portal Access: Provides a registration and access system for insurance agents to conduct business and engage with client-specific portals.

4. Advanced Functionalities: Incorporates features like automated alerts, email notifications, customizable branding options for agents, and special offers targeted at customers.

5. Administrative Capabilities for Agents: Allows agents to adjust subscribers' PINs and update policyholder information within the portal.

6. Customer Service Enhancement: Facilitates customer service representatives in efficiently locating policy details and contacting clients as necessary.

7. Streamlined Claims Processing: Assists carriers in processing claims electronically, thereby expediting the claims handling process.

Benefits of using Insurance Portal Software

There are several advantages of using Insurance Portal Software and they are as follows:

1. Simplified User Interface

Insurance portal software significantly simplifies the purchasing process for customers. It provides an easy-to-navigate interface, allowing users to understand and buy insurance policies with enhanced clarity about the policy details.

2. Enhanced System Flexibility

These portals offer remarkable flexibility, enabling insurers to define varied roles and access permissions for different stakeholders in the insurance ecosystem. This adaptability is crucial in managing the complex dynamics of insurance operations.

3. Improved Customer Experience

The design of Insurance Agent Portal Software focuses on managing large volumes of data efficiently, ensuring minimal latency. This capability is instrumental in boosting the overall customer experience, making these tools vital for customer satisfaction.

4. Streamlined Processes for Agents and Business Owners

For agents and business owners aiming to refine the insurance process, insurance portal software serves as a comprehensive solution. It not only simplifies procedures but also significantly enhances the experience for policyholders.

5. Integrated Data Analysis Tools

Insurance portals come equipped with data analysis functionalities. These tools allow insurers to extract and utilize valuable insights from large data sets, aiding in more informed decision-making.

6. Safeguarding Against Complexity in Core Transformation and Business Change

The software helps in minimizing the need for rework by aligning the requirements of both the portal and the core system progressively. This approach effectively shields clients from the intricacies involved in core transformation and business changes.

7. Synergies Between Portal and Core System

Insurance portal software enables carriers to fully leverage the Features of core system transformations. It facilitates carriers in extending these benefits to their agents, ultimately leading to a more cost-effective and efficient insurance ecosystem.

Top 15 Insurance Portal Software

The top 15 platforms offering the best insurance portal software are as follows:

1. Bitrix24

Bitrix24 is set up to handle health insurance and insurance sales so that customers can enrol online.

The CRM can receive leads directly from a user's website (for instance, from an order or feedback form).

Additionally, it facilitates the development of customized client portals. Then, users can make message templates, send contacts and lead individual or group emails, record client interactions in notes, set up meetings, and more.

With the help of the client management tool Bitrix24, companies can keep track of and organise their communications with partners and customers, both current and potential.

Users of the software can create sales reports, collect and store lead data, and log and manage client interactions.

Key Features

- CRM system for managing customer interactions in businesses

- Plan and automate events, meetings, and tasks.

- Share files, calendars, and notes in one location to facilitate project collaboration.

- Large data handling capacity in offline mode

- SaaS solution that enables companies to centrally manage customer relationships

- Built-in tools for managing tasks, events, and projects.

- CRM system for business owners to record customer interactions.

- Creates sales reports, aids sales managers in understanding the sales pipeline.

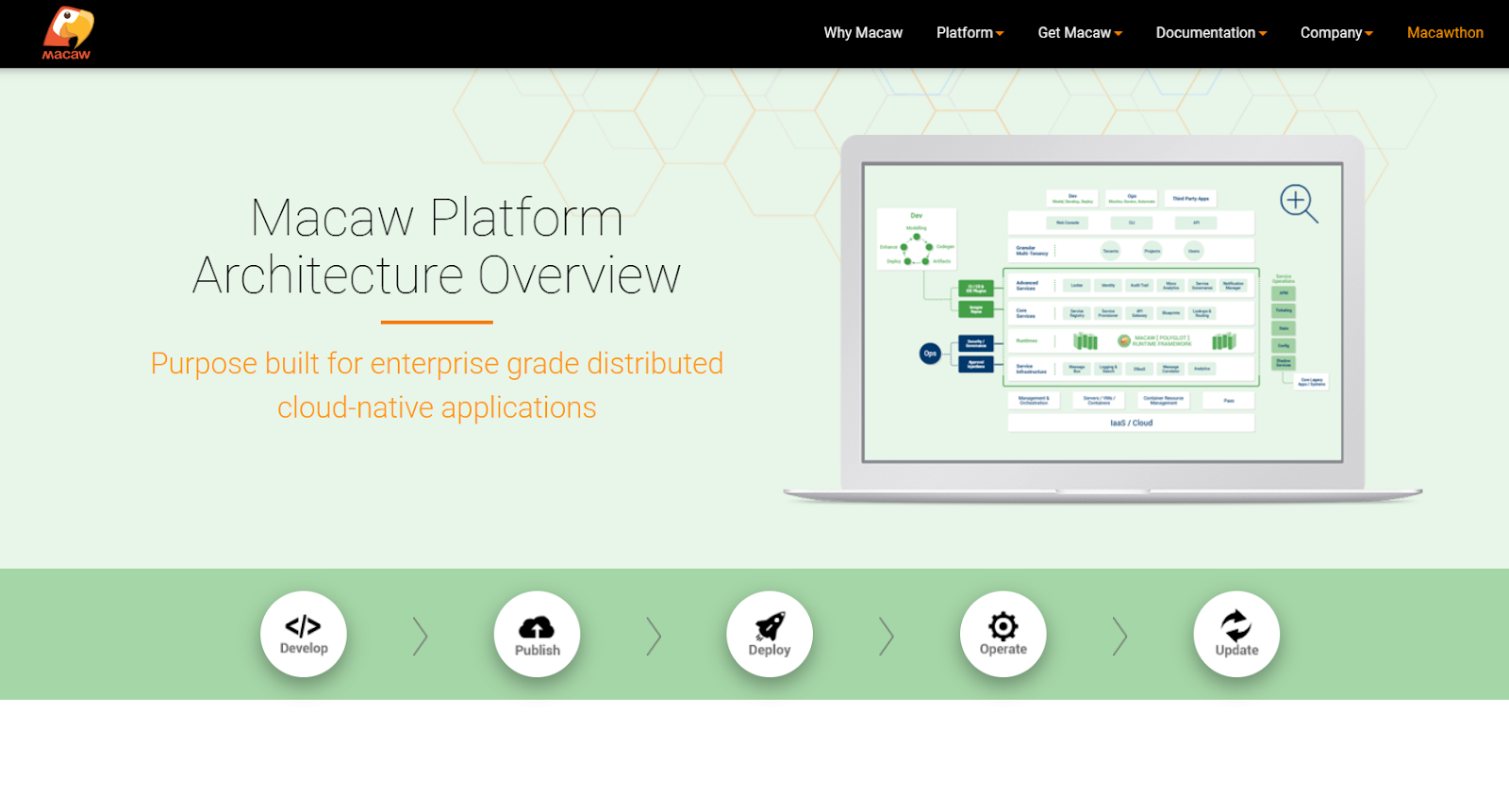

2. Macaw

A management system for insurance agencies called Macaw enables end-to-end operations for MGAs, programme managers, brokers, and independent agents.

In addition to self-service portals for consumers and producers, billing and payment options, policy management, reporting, and analytics are all provided by Macaw.

Owners of insurance agencies can manage their clients with the aid of this software. a task and event management tool that is already built in, saving time organising routine tasks.

It is a carrier-centric system that supports the creation and marketing of new products as well as the management of policies and business intelligence.

Additionally, Macaw offers ready adaptors for telephony providers, payment gateways, automated email marketing tools, and eSignatures.

Key Features

- Automated workflows and document management

- Key performance indicator (KPI) dashboards for business intelligence, analytics, data vizualisation tools, and ROI reporting.

- The online portal provides a variety of tools for managing insurance agencies.

- System for managing documents that allows for quick access and storage.

- Built-in integrations with top solutions for billing, agent portals, and marketing automation.

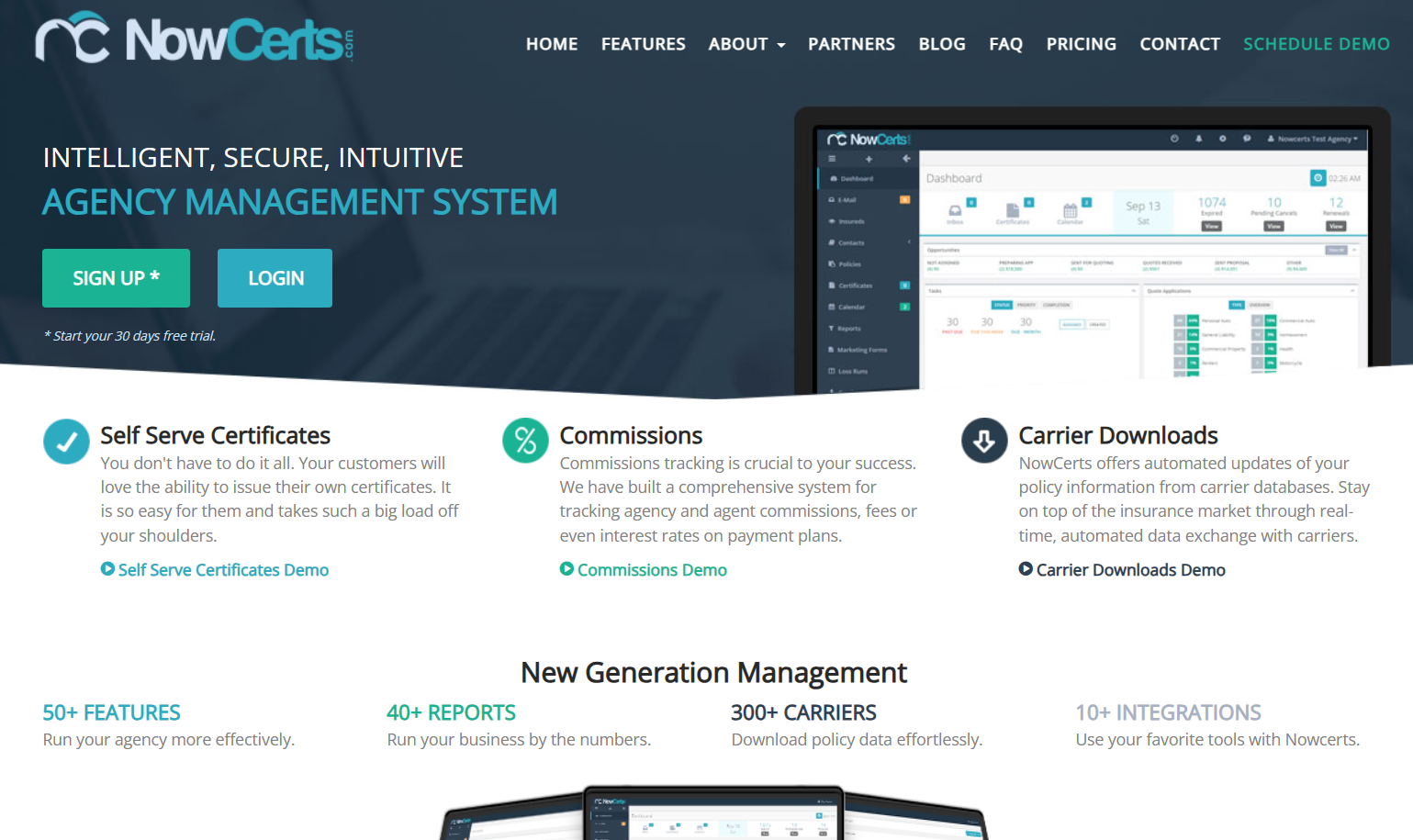

3. NowCerts

With both insurance companies and independent insurance brokers in mind, NowCerts is a user-friendly, cloud-based agency management system (AMS).

Tools for tracking commissions, self-serving certificates, ACORD forms, email synchronisation, loss runs, carrier downloads, raters integration, and other features are available in this agency management software.

It is a cloud-based platform that facilitates the management of daily tasks for brokers and agents. This website serves as a platform for insurance agents to obtain their certificates online. It offers all the details needed to obtain the certificate in one location.

The carrier-centric software supports the creation and marketing of new products, as well as the administration of policies and business intelligence.

Insurance brokers can manage customer acquisition, management, and retention with the aid of NowCerts.

Key Features

- Protection from authorized interference using encryption and authentication

- Multilingual, customizable interface

- Built-in task manager tool.

- ACORD library

- Enables integration with carriers so that clients can look for new quote

- Mobile adaptability

4. FileTrac Evolve

Independent adjusters, managing general agents (MGAs), third-party administrators (TPAs), and insurance companies of all sizes, from small businesses to large companies with multiple branches, can use FileTrac, a web-based claims management system.

FileTrac is made to handle every aspect of claims management, from assignment to archiving. This includes data entry, uploading of reports, images, and videos, communication with clients and internal staff, time and expense logging for adjusters, invoicing, and adjuster payouts.

This all-inclusive software aids in the management of claims by insurance adjusters. It is a platform with all the resources required for effective claim management.

Real-time case updates are one of its most crucial features among many others. An easy-to-use activity feed keeps adjusters informed of every change to their cases.

It has a built-in task manager that manages the tasks that managers assign. Additionally, it gives users access to a wide range of templates, making it easier for insurance companies to obtain new quotes.

Users of FileTrac can fully automate the claims process, from assignment to resolution.

Key Features

- Client, claims staff, adjusters, and supervisor alerts and reminders

- Dashboards for claim status that allow for data reporting at a deeper level.

- Reports on advanced activity and the audit trail for compliance and auditing.

- Built-in workflow engine that is simple to use.

- Software for managing claims that enables task assignment to the appropriate personnel

- Integrated task management tool created to handle tasks delegated by supervisors or insurance adjusters.

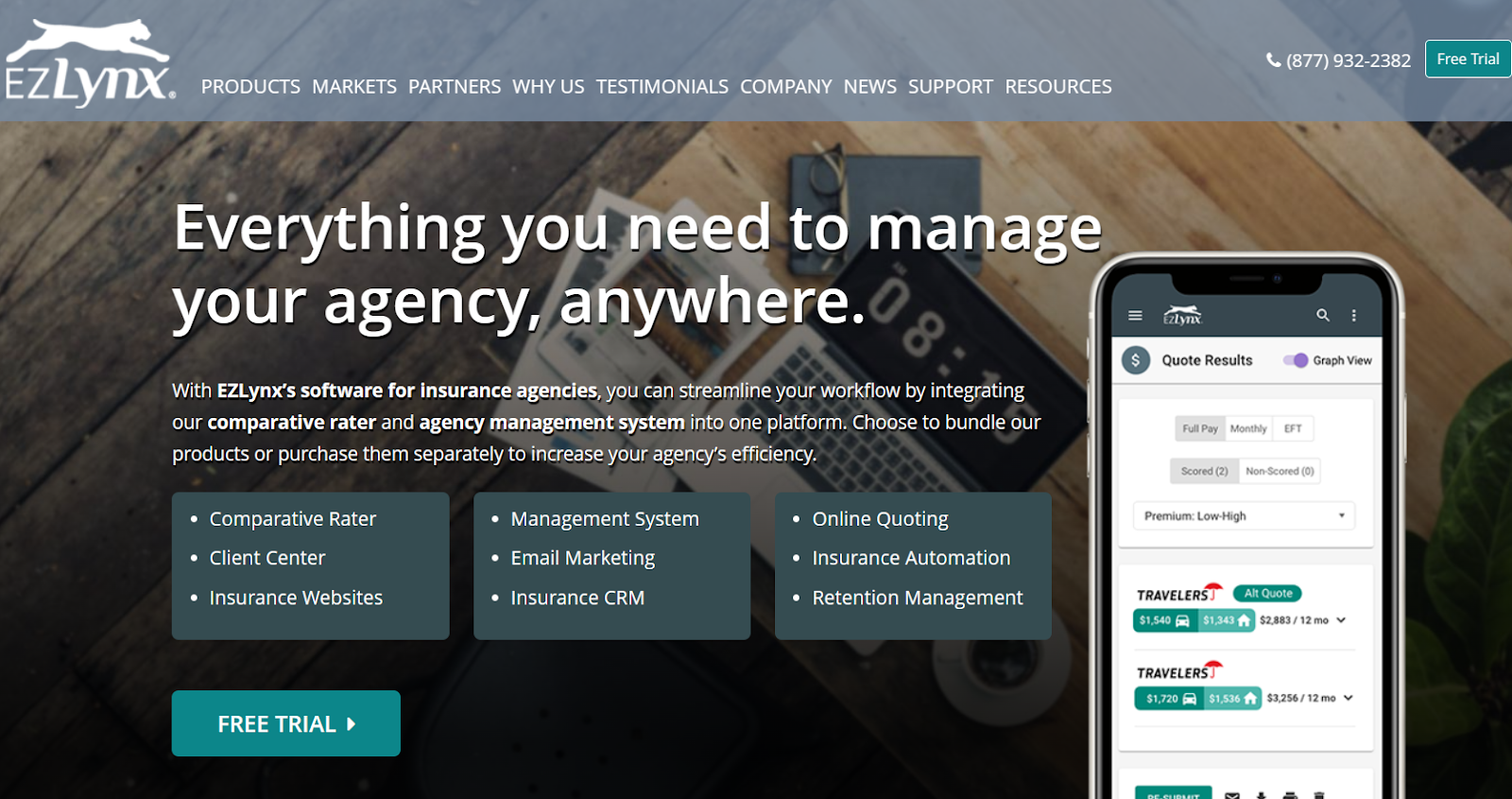

5. EZLynx

A cloud-based solution called EZLynx aids insurance companies in streamlining procedures for email marketing, customer retention, lead management, and online quoting.

Users can generate pre-filled cost valuations, submit quotes, and store Association for Cooperative Operations Research and Development (ACORD) forms using the rating engine.

The system stores every transaction, making it simple to later review them. By generating newsletters and email campaigns, the platform assists insurance companies with customer retention management.

The automatic data sync feature transfers information from clients to prospects, ensuring that all contact information is up to date. Through the course of a prospect's life cycle, these features aid agents in nurturing those relationships.

Key Features

- Manage and track leads

- Management of client relationships in a single online space

- Automates partner and client communication.

- Creation and delivery of newsletters.

- ACORD forms are stored for quick retrieval, and there is the option to add new forms easily.

- Automatically syncs with the client's contact information.

6. Velocity

In order to configure and manage workflows for their daily operations, insurance agencies can use Velocity, a comprehensive insurance solution.

The solution offers a comprehensive insurance software package for the property & casualty sector that has been created to meet the needs of programme administrators, wholesalers, small carriers, reinsurers, and specialty retailers as well as MGAs (Managing General Agents) and MGUs (Managing General Underwriters).

Key Features

- Integrated rating engine

- Solution driven by parameters.

- Reinsurance compliance.

- Modified workflow management.

- Tracking production and data import.

- Administration of policies, including endorsements and renewals.

- Daily policy fulfilment tasks like accepting new business, documenting policies, and reviewing, submitting, and storing payments, customer service and billing

7. Indio

A cloud-based P&C insurance agency solution called Indio, it facilitates and manages the insurance application and renewal procedures.

The platform includes a form engine that enables businesses to display conditional questions in order to get client responses on particular fields.

The creation of notes, automatic data populating, digital signature, file import, and data security are some of Indio's key features.

By adding multiple contacts to the platform, customers can leave notes for agents on questions they are unsure of or share forms with various departments to work together on pertinent fields.

Common file formats can be supported by the built-in file reader, and users can verify the legitimacy of files using digital signatures.

Key Features

- Accessible through any internet-connected device

- Data entry for forms and documents is automated.

- Multiple users within the account have the ability to share files, or they can share files on a platform like Google Drive, Dropbox, Box, etc.

- Data encryption and two-factor authentication for strengthened security.

- Integrates billing platforms, reporting engines, and CRMs.

8. HealthSherpa

A cloud-based platform called Health Sherpa was created to assist healthcare organisations of all sizes in streamlining their client management, enrollment, and quote processes for the Affordable Care Act (ACA). The best insurance software is this one.

Agents can use the platform to submit applications, follow up with clients, and check the status of approval.

Any mobile device, including phones and tablets, with a browser can access and use HealthSherpa.

Key Features

- produces estimates for subsidies, compares and views healthcare plans, and generates quotes.

- Leads are organized, and clients keep track of the status of documents.

- Create individualized websites with unique logos.

- A one-stop shop for brokers and agents to enroll ACA clients.

- Reminders to promote adherence to the law.

- As needed, users can communicate directly through the platform thanks to integrated messaging capabilities.

- Supports email-based document sharing.

- Keeps track of additional data for the ACA application process (such as pay stubs, documentation, etc.)

- Statistics and analyzes to track demographic information.

9. A1 Tracker

The cloud-based enterprise risk management platform A1 Tracker was created to assist companies of all sizes in managing and reducing risks associated with contracts, migrations, insurance, assets, and claims processes.

Users of the platform can track, report, and manage trends, which lowers the risk of claims for insurance premiums, worker's compensation, product liabilities, and accounts receivable. The platform includes a claim management module.

A professional services tracker, which is intended to be used on fixed assets and enables users to track the location of assets as well as their associated insurance policies and workers' compensation claims, is also included with A1 Tracker.

Key Features

- Asset-management programme

- Client, claims staff, adjusters, and supervisor alerts and reminders

- Assesses threats and keeps an eye on operations.

- Lead management and reporting

- Create custom fields to keep track of additional ACA application-related data (such as documentation, etc.).

- Incorporates ERP and CRM systems.

- Detailed view of reports on managing risk for contracts, assets, and insurance policies.

10. InsureCert

With the help of the cloud-based InsureCert insurance policy system, insurers, brokers, and managing general agents can create online stores, manage quotes, take payments, and issue Property and Casualty (P&C) policies from a single, centralised platform.

InsureCert aims to provide a complete insurance policy solution by integrating level one Payment Card Industry (PCI) compliance, custom landing pages, and a RESTful API.

To give users immediate access to more than 200 carriers, the platform integrates with an external carrier network.

With InsureCert, users can create white-labeled websites with customised landing pages, integrated and Development (ACORD) forms, generate pre-filled cost valuations, and submit quotes on a centralised platform. This software is designed to offer a full e-commerce solution.

Key Features

- Modules with support from industry

- White-label branding modeling

- Pricing and multi-rating engine

- Make it simple for users to create and send quotes to clients

- Support for clients and agents via live chat

- Utilizing personalized landing pages, sell insurance policies online

- Distribution of premiums, payouts, and commissions

- Utilize reports and alerts to keep an eye on fraud indicators

- Create and distribute certificates and related paperwork

- Maintain a record of the status of the policies and the claims they cover

11. CaptalMS

CaptalMS is an intuitive insurance management tool that facilitates workflow optimization for small insurance companies. It aids agencies in centrally organising and managing all leads and clients.

Agencies using CaptaIMS have the option of tracking personal, commercial, life & health, or specialty lines of business.

The platform offers a way to track and report on every aspect of the agency, including agents, employees, and even clients. This can ultimately help with employee retention among other things.

It has tools for controlling commissions, handling business expenses, producing personalised reports, and planning advertising campaigns.

Additionally, the software provides tools for managing client data, such as contact details, agency expiration dates, and notes. Seven days a week, live support is available for the platform via phone, email, or chat.

Key Features

- Management of leads, policies, and documents

- Real-time client information access

- To keep track of additional data for the ACA application process (such as pay stubs, documentation, etc.), create custom fields

- Keep track of insurance policies and the claims they cover

- Real-time commission administration and payment to agents and employees

- Agency contact management (e.g., clients and prospects)

12. Sage

Sage's AI-powered knowledge management system gives carriers and brokers instant access to the data they need to run their businesses.

Our cloud-based system, which has been trained on millions of industry-specific conversations, speaks the language of insurance to instantly uncover information hidden within documents.

glean learnings from previous conversations that can help with new conversations.

Regardless of how it is encoded in a policy document, it delivers accurate, real-time information about what a policy covers and the associated costs.

Based on the unique requirements of each prospect, carriers can instantly personalize their goods and services.

Key Features

- Customer-facing Portal

- Data entry for forms and documents is automated

- Automated, scalable discovery processes

- Identify the ideal distribution channels, marketing initiatives, and product features.

13. BriteCore

A modular insurance platform called BriteCore provides tools for handling claims, administering insurance policies, and centralising client databases. BriteCore is a cloud-based application that is installed on Amazon Web Service (AWS) and can be accessed from any device with a typical web browser.

P&Cs, MGAs, enterprise-level insurance carriers, startups, and other companies in the insurance sector are all served by the solution.

The Brite Policies product offers interactive tools for managing every stage of the policy lifecycle, from application to final claim settlement.

Key Features

- Module for advanced billing and receiving accounts

- Internal policy rates set up for various user categories

- Adapt permissions for various user groups

14. VUE

An application for managing sales commissions and distribution that is primarily targeted at the insurance industry is called VUE VUE.

VUE Onboarding & Compliance, VUE Distribution Compensation, and VUE CRM for Insurance are the three integrated modules that make up the solution.

The integrated solution includes functions like self-service portals, electronic onboarding, compensation planning, and compliance management.

Insurance companies can automate the onboarding of new producers using VUE Onboarding & Compliance. The module includes options like background checks and one-click synchronisation with NIPR and PDB.

Additionally, it offers resources for tracking producer data, calculating commissions, and maintaining compliance.

Key Features

- Multi-channel marketing automation, including SMS and email campaigns

- Business intelligence dashboards for better decision-making

- Social media integration with Facebook Messenger Bot

- Track lead generation and manages client relationships

15. Summit Dpath

Summit Dpath is a platform for cloud-based benefits administration created to assist TPAs (third-party administrators) in managing and implementing employer-sponsored benefits in the US.

Summit was designed from the ground up to manage CDH and COBRA accounts with ease. Administrators can create a variety of account-based plans, both simple and complex, including medical wellness dental vision, and more, using the full-service solution.

Differentiated deductibles, varying employee/employer responsibility, are all managed by Summit.

Key Features

- Record-keeping and administration procedures

- Complete access control

- Co-insurance rates, and rollover

- Customer live chat support

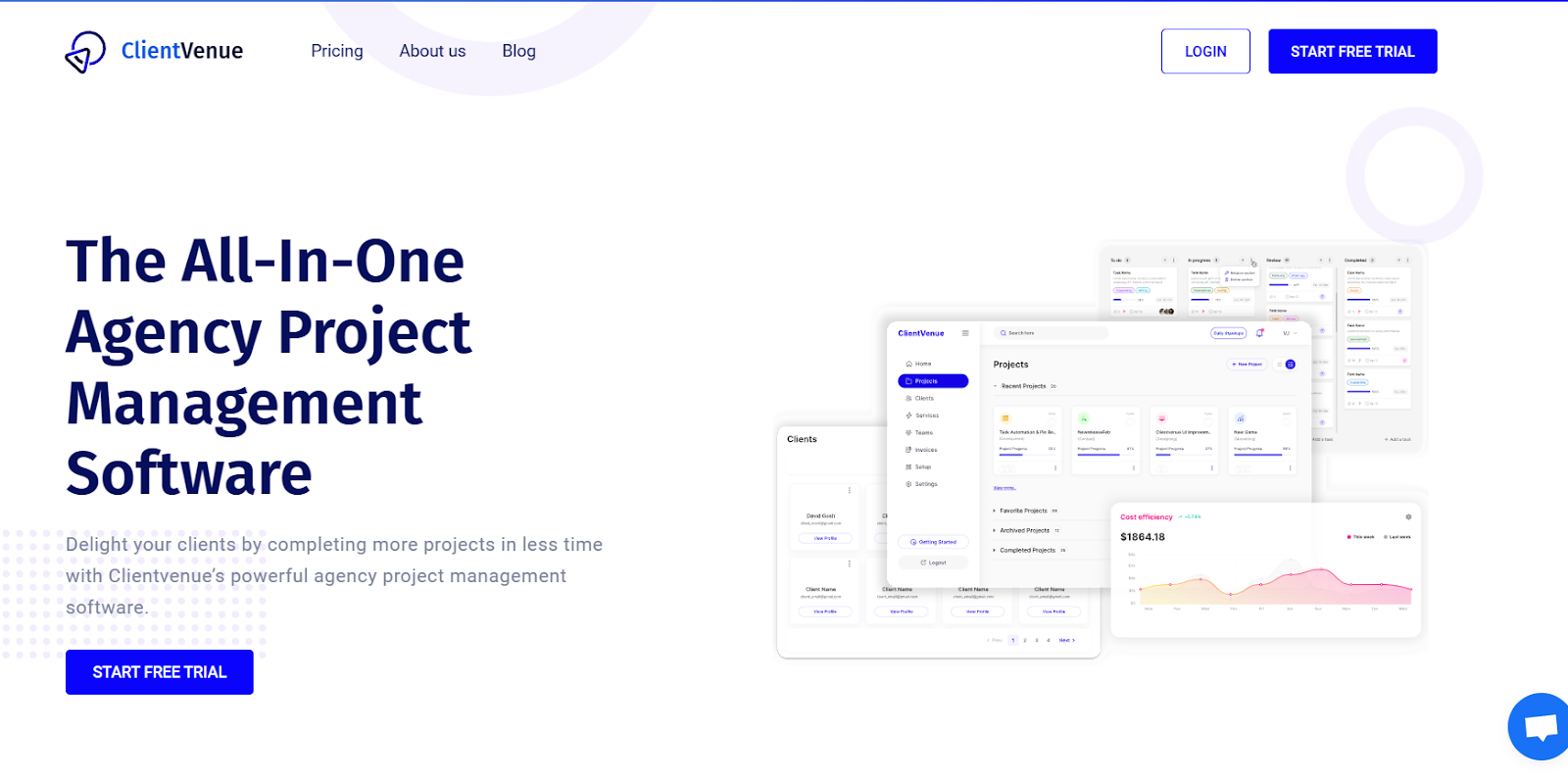

Enhance your Agency Operations with ClientVenue: A Leader in Agency Management

In the competitive world of insurance, the right tools are crucial for staying ahead. ClientVenue, our advanced Agency Management Software, has been crafted to elevate insurance agency operations. ClientVenue stands out as an essential resource, offering innovative solutions that reshape industry practices.

ClientVenue embodies these crucial features, positioning itself as a comprehensive and user-friendly solution for insurance agencies looking to optimize their operations and provide exceptional service.

1. Comprehensive Policy Management

ClientVenue offers an advanced policy management system that simplifies handling various insurance policies, ensuring smooth operations from creation to cancellation.

2. Integrated Customer Relationship Management (CRM)

The software includes a CRM tool tailored for the insurance industry, helping agencies manage customer information, track interactions, and improve client engagement.

3. Billing and Payment Processing

The platform integrates billing and payment processing, simplifying financial transactions related to policies and claims.

4. Robust Document Management

With ClientVenue, agencies can efficiently organize and store essential documents, ensuring security and easy access.

5. Reporting and Analytics

ClientVenue offers powerful analytics tools, enabling agencies to generate valuable insights from policy, claims, and customer data.

6. Automated Workflow Capabilities

ClientVenue automates routine tasks, enhancing efficiency and reducing the potential for manual errors.

7. Seamless Integration with Other Systems

It is built to integrate effortlessly with various external systems and software, enhancing its utility.

Conclusion

To maximize efficiency and conserve resources, it's crucial for insurance companies to choose the right portal software. An effective solution simplifies managing customer relationships, tracking leads, and executing automated marketing campaigns.

The solutions highlighted above stand out in the industry, offering a diverse range of features that cater to various insurance business needs. This makes them some of the top choices for insurance carriers looking to streamline their operations and enhance service delivery.

ClientVenue emerges as a standout choice in the world of insurance portal software, harmoniously blending the best of both worlds.

By encapsulating the essential benefits of top-tier insurance portal software — such as streamlined policy management, enhanced customer experiences, and flexible system adaptability — it sets a new standard in the industry.

For agencies seeking to optimize their processes, improve client engagement, and stay ahead in a competitive market, ClientVenue offers an unparalleled solution that encapsulates the best of insurance portal software capabilities.

Choosing ClientVenue means choosing a future where efficiency, innovation, and customer satisfaction converge seamlessly.